Posts

In the event the either fits the newest filing requirements to own nonresident aliens chatted about in the a bankruptcy proceeding, they need to document separate productivity since the nonresident aliens to have 2024. In the event the Manhood will get a citizen alien again within the 2025, the option is not any longer suspended. When there is zero worker-company dating ranging from you and the individual for the person you perform functions, the settlement try subject to the newest 29% (or down treaty) rate away from withholding. A binding agreement which you come to on the Irs of withholding from the compensation to own separate private functions is useful to have repayments protected by the agreement immediately after it’s wanted to from the all the people. You ought to invest in punctual document a tax get back to own the current income tax seasons. You should file a joint New york State come back using submitting condition ②‚ you need to include in the Government count column the newest joint money since the stated on the federal income tax come back.

- Simultaneously, a good taxpayer might not document an amended go back tricky the new agency’s coverage, its interpretation or even the constitutionality of your own Commonwealth’s regulations.

- For every dependent getting claimed without an enthusiastic SSN and you will a keen ITIN, an application FTB 3568 need to be provided and support documents.

- Some states need shelter dumps to be stored in another trust membership install specifically for one purpose.

- Until an excellent taxpayer are outside of the U.S., the brand new agency does not give an extension for over half a dozen months.

- Under You.S. immigration legislation, a legal permanent resident who is necessary to document a taxation come back because the a resident and you will fails to get it done is generally considered to be having abandoned condition and may also eliminate permanent citizen status.

For the reason that the factors on what the brand new pact exclusion try founded may not be determinable up until after the intimate of your own taxation 12 months. In this instance, you should file Function 1040-NR to recover one overwithheld tax and deliver the Irs which have proof that you’re permitted the new treaty exclusion. Next earnings is not at the mercy of withholding at the 29% (or all the way down pact) rates if you document Mode W-8ECI to your payer of one’s earnings.

The brand new landlord’s help guide to rental security dumps

Some says do not control where you need to shop defense places, but someone else require you to place for each put within the a new interest-affect membership. Assemble the complete shelter deposit just before a tenant movements to your a good leasing. This ought to be a disorder of your lease, so if a renter is unable to provide the complete count upfront, you could cancel the newest lease and you may lease to some other prospective tenant just who has been thoroughly processed. No, the newest lease nonetheless governs your own reference to your own citizen. Actually, all of our service is in place to cover you and to restrict your risk.

Instead, it is the pounds of all points you to definitely find in which condition you are domiciled. In the event the all of the around three criteria try came across, the newest day of the changes is the first-day out of genuine bodily presence in the the fresh area. Local, county, and you may government other sites often result in .gov. Commonwealth out of Pennsylvania government other sites and you will current email address possibilities explore „pennsylvania.gov” otherwise „pa.gov” at the end of the new address. Just before sharing sensitive and painful otherwise personal data, make certain that you are on an official state site.

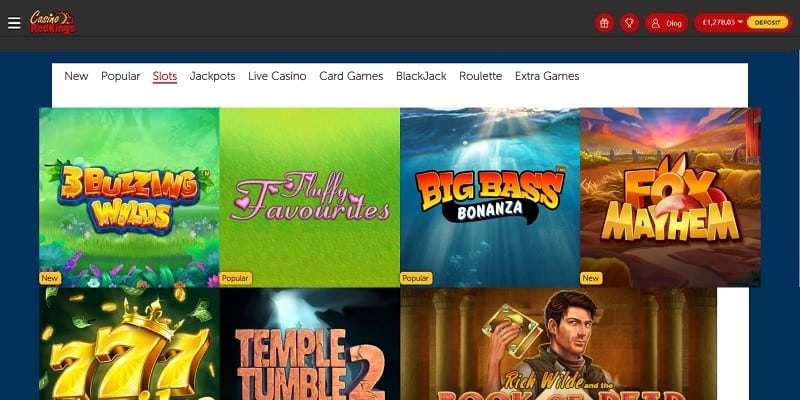

If they merge your money making use of their own private finance, regulations claims they must return your put instantaneously. Such as many other claims, landlords also are required to tell you and therefore bank they’re using to store your own put. For many who https://realmoneygaming.ca/paysafecard-casinos/ let us know by mouth, we would require you to send us the criticism otherwise concern on paper within ten (10) working days on the above target. We will tell you the outcomes of our analysis within 10 (10) business days if we listen to from you and will correct one error promptly.

New york Condition tax

Enter into the money as part of the Government matter line one to your received out of New york State offer. When you are needed to document Mode They-203-C, tend to be one another your own Personal Security count as well as your companion’s. If perhaps you were a great nonresident of new York Condition, you are susceptible to Nyc State tax to your earnings derived out of New york Condition supply. For all your age-document alternatives, find Filing Season Financing Center on the website. Checking account makes it possible to manage your money in versatile suggests.

Credible Software Organization

That is correct even if we pursue our very own Availableness Timelines provided more than and provide you with Controls CC disclosures or observes. Occasionally, we are going to perhaps not make all fund which you deposit by the view on the market on the plan explained above. Despite i have produced fund on the market and you has taken the cash, you are still in charge or no put for you personally is actually returned, rejected, if not uncollected because of the Lender. One purchase you conduct for the Saturday, Week-end, a federal getaway, and other weeks on what we are signed may be treated the next business day. Harmony formula approach – I make use of the everyday balance method of estimate the interest on the your account.

Range 39: Ny County house borrowing from the bank

You can even file a casual allege for refund while the complete number due as well as taxation, punishment, and you may attention has not yet already been paid. Following the full matter owed has been paid, you’ve got the to appeal to any office away from Tax Appeals in the ota.california.gov or even to file suit inside the court if your claim for reimburse is actually disallowed. Late Commission beneficial Income tax – To prevent later commission penalties for use taxation, you ought to report and pay the play with taxation that have a prompt submitted taxation return otherwise Ca Private Have fun with Taxation come back. For individuals who didn’t itemize deductions on the government tax get back but tend to itemize deductions for the Function 540, earliest complete federal Schedule A great (Setting 1040), Itemized Write-offs. Up coming look at the box to your Front side 5, Region II of your own Schedule Ca (540) and you will done Region II.

For those who gone to the Nyc State, tend to be things you will have to report if you were submitting a federal go back to your accrual basis for that point before you changed your own citizen position. If a person people are a new york County resident and one other try a good nonresident otherwise area-season citizen, you must for every document a new Ny come back. Although not, for individuals who both choose to document a shared New york Condition return, have fun with Form It-201 and you can one another spouses’ income will be taxed as the complete-year citizens of new York State. The newest fiduciary (executor, administrator, or any other people faced with caring for the newest decedent’s possessions) need document the fresh income tax get back for anyone who died through the the new income tax year. The newest fiduciary files the fresh go back while the „Deceased,” and you may accounts all the earnings the new decedent gotten from the beginning out of the newest tax seasons to your day of death. Any return filed for a dead personal have to let you know the newest day from death on the appropriate range.

Simple Joint Filer Relief

But not, of several taxation treaties provides conditions for the protecting term, which could enable it to be a citizen alien to continue so you can allege pact professionals. All of the treaties has terms to your exception cash earned from the certain team out of overseas governments. Although not, a difference is available one of treaties concerning which qualifies for this benefit.

Najnowsze komentarze